Your challenges

Operational taxes are constantly subject to arrays of new, evolving, and complex regulations. It means today’s financial intermediaries are facing increasing volumes of work.

Product sheet

Helping financial intermediaries to stay on top of tax processes, handling data driven requirements for operational taxes more efficiently.

Operational taxes are constantly subject to arrays of new, evolving, and complex regulations. It means today’s financial intermediaries are facing increasing volumes of work.

This presents new risks for any financial intermediary wanting to remain competitive while offering tax services.

Intermediaries are expected to accurately handle trading data and income generated from financial assets in a timely and compliant approach. All the while providing best in class tax relief services.

Success thus depends on an ability to access reliable and trustworthy data and solutions that are enterprise grade, reliant, and scalable.

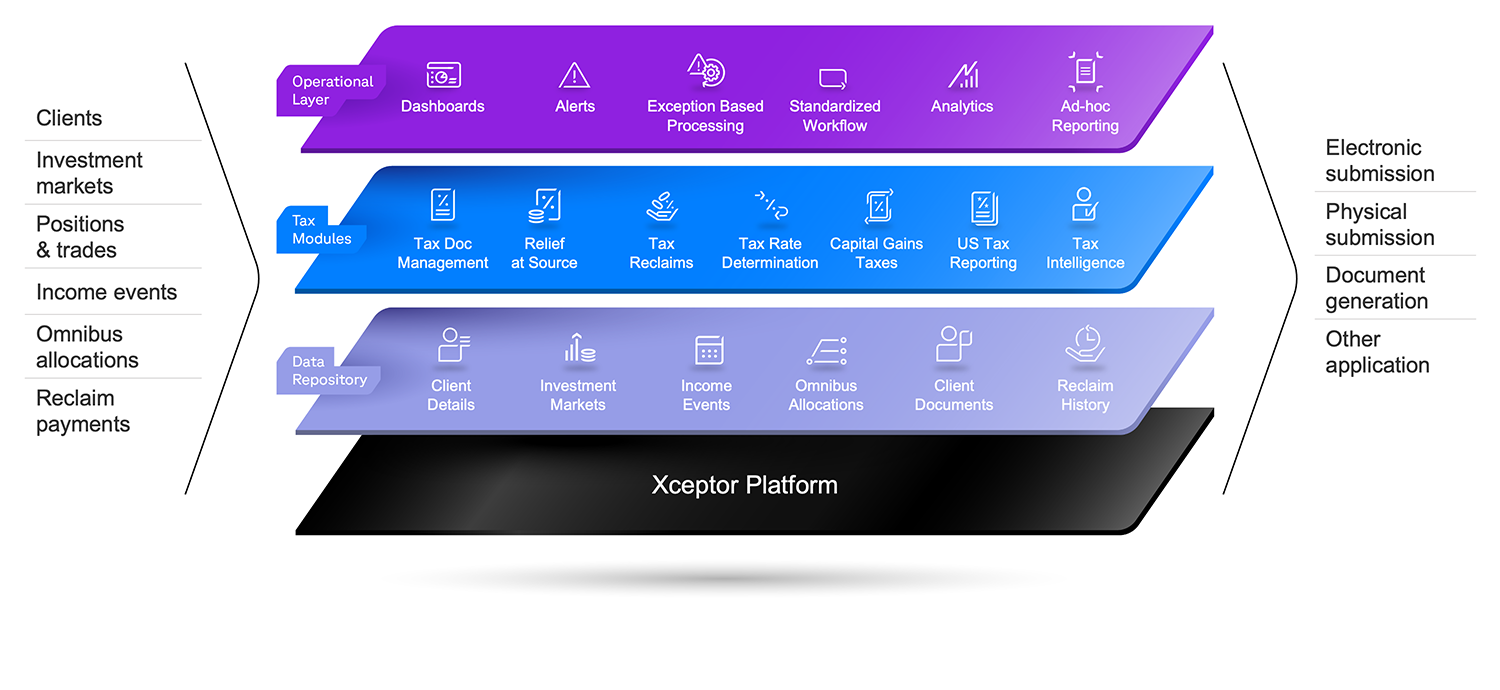

In a single solution, Xceptor delivers end-to-end tax processing capabilities. Our cutting-edge data processing technology reduces risk caused by inaccurate data, increases efficiency through a smarter workflow, and minimizes duplication. The result is transformed tax operations.

The Xceptor Tax Processing solution provides an automated and optimized documentation workflow ensuring correct tax is withheld.

A market leader in tax data automation, Xceptor is trusted by some of the largest global financial institutions, including Deutsche Bank, Northern Trust and US Bank.

Xceptor Tax Processing is used in seven key areas:

1. Tax documentation management

2. Tax relief at source

3. Tax reclaim management

4. Tax rate determination

5. US tax reporting

6. Transaction / capital gains taxes

7. Tax intelligence*

Key features include:

Automated capture, production, renewal, and solicitation of all documentation required to achieve tax relief (via RAS or Reclaim).

Automation of processes required for RAS, including collection, production, and submission of breakdown of holdings on omnibus accounts, tax elections, withholding statements.

End-to-end tax reclaim processing, from income payment and reclaim opportunity capture to end payment reconciliation.

Tax information, calculations, documentation requirements, and other data supplied to output channels and upstream systems.

Automated reporting process through data ingestion, reconciliation, operational processes and onward report production and distribution. Addresses specific requirements of US regulatory tax reporting around 1042-s, 1099 and annual IRS submission.

Management of rules to automate the process of capturing liable transactions, calculating amount of tax to charge and reporting it to clients, tax authority, or withholding agent.

Capture regulatory alerts and manage regulatory change through structured workflow, including production and distribution of market updates to end clients, using a fully controlled and auditable tool.

Manage intricacies and challenges of complex withholding tax requirements, transaction taxes and tax reporting.

Configure your own rules to reduce dependence on other teams.

Seamlessly integrate with your internal data sources and existing applications.

Safeguard your business with a strong focus on control, risk management, and regulatory compliance.

Fully auditable with control mechanisms.

Scalable solution providing live intra-day tax calculations and processing millions of documents and transactions annually.

Manage intricacies and challenges of complex withholding tax requirements, transaction taxes, and tax reporting.

Configure your own rules to reduce dependence on other teams.

Seamlessly integrate with your internal data sources and existing applications

Safeguard your business with a strong focus on control, risk management, and regulatory compliance.

Fully auditable with control mechanisms.

Scalable solution providing live intra-day tax calculations and processing millions of documents and transactions annually.

The Xceptor Tax Processing solution provides an automated and optimized documentation workflow ensuring correct tax is withheld. Key features include:

Automated capture, production, renewal, and solicitation of all documentation required to achieve tax relief (via RAS or Reclaim).

Watch our demo

Automation of processes required for RAS, including collection, production, and submission of breakdown of holdings on omnibus accounts, tax elections, withholding statements.

Watch our demo

End-to-end tax reclaim processing, from income payment and reclaim opportunity capture to end payment reconciliation.

Tax information, calculations, documentation requirements, and other data supplied to output channels and upstream systems.

Automated reporting process through data ingestion, reconciliation, operational processes and onward report production and distribution. Addresses specific requirements of US regulatory tax reporting around 1042-s, 1099 and annual IRS submission.

Management of rules to automate the process of capturing liable transactions, calculating amount of tax to charge and reporting it to clients, tax authority, or withholding agent.

Capture regulatory alerts and manage regulatory change through structured workflow, including production and distribution of market updates to end clients, using a fully controlled and auditable tool.

Mathew Kathayanat

Head of Product - Asia Pacific for Securities Services

Product enhancements such as the automation of tax processes, which we will look to replicate in other markets, directly benefit our foreign institutional clients such as global custodians, sovereign wealth funds, and asset managers by providing faster turnaround times and improved accuracy.

Speak to a tax specialist today.

* For operational teams managing regulatory change