Xceptor for Regulatory Reporting

Transform Compliance with Data Automation

What can it do for you?

Xceptor delivers an optimized reconciliation process for greater accuracy and control – putting the power into the hands of the people that understand the business, and the data, the best.

-

Reduce manual effort Speed up balancing and correct discrepancies by ingesting and preparing the data up front

Reduce manual effort Speed up balancing and correct discrepancies by ingesting and preparing the data up front -

Accelerate time to market Respond quicker to market changes, and onboard new brokers / markets / instruments faster.

Accelerate time to market Respond quicker to market changes, and onboard new brokers / markets / instruments faster. -

Eliminate errors Proactively spot and resolve trade mismatches without manual intervention.

Eliminate errors Proactively spot and resolve trade mismatches without manual intervention. -

Total oversight Gain a comprehensive real-time snapshot of equity balances encompassing P&L, trades, positions, and cash flows in one consolidated view.

Total oversight Gain a comprehensive real-time snapshot of equity balances encompassing P&L, trades, positions, and cash flows in one consolidated view.

Regulatory reporting is a moving target -

Are you keeping up?

As global financial regulations multiply and grow more complex (MiFID II, EMIR Refit, CSDR), the pressure on capital markets participants intensifies. Financial institutions need to deliver accurate, timely regulatory reporting while adapting quickly to evolving compliance requirements. However, most organizations rely on rigid IT systems that create bottlenecks when regulations change. This dependency leads to costly and prolonged development cycles, manual workarounds, and increased operational risk (due to an inability to adapt quickly).

The result is a cascade of problems:

Firms caught between regulatory deadlines and IT constraints increasingly seek technology solutions that put

control back in the hands of the business

The smarter way to automate regulatory data prep

Xceptor empowers operations teams to control their compliance destiny through a purpose-built automation platform that removes IT dependencies from the reporting process so they can react quicker to regulation changes.

Our solution bridges the gap between disparate source systems and your regulatory reporting engines so you can future-proof your compliance and adapt regardless of how regulations evolve.

Comprehensive Data Integration

Comprehensive Data Integration

Automatically ingest data from any source — structured or unstructured — including proprietary systems, industry standard platforms, and manual inputs.

Intelligent Data Transformation

Intelligent Data Transformation

Apply complex business logic to normalize, validate, and enrich data according to regulatory specifications.

Business-Led Rule Management

Business-Led Rule Management

Configure and modify data transformation rules when regulations change (without code), eliminating IT bottlenecks.

End-to-End Auditability

End-to-End Auditability

Maintain complete data lineage and transformation history to satisfy regulatory scrutiny and internal controls.

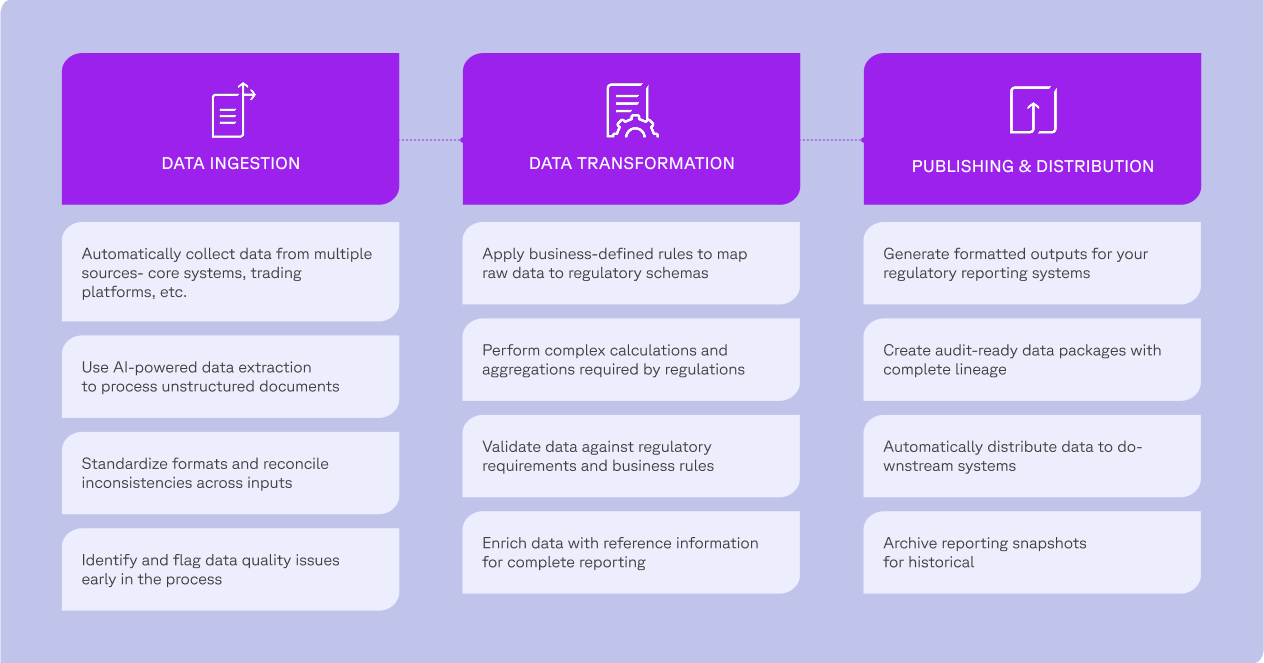

Your regulatory reporting workflow

Empower business users with a data schema they can adapt as and when regulations change.

Regulatory reporting without the operational drag

Reduce regulatory change time

Implement new requirements in days rather than months with business-led rule changes.

Cut operational costs

Eliminate manual data manipulation and reduce FTEs (or reliance on outsourced resources) while also decreasing IT development expenses for regulatory change.

Mitigate compliance risk

Ensure consistent data quality, remove human error, and maintain clear audit trails for regulatory scrutiny.

Redeploy skilled resources

Free your regulatory experts from data preparation tasks so they can focus on compliance strategy and regulatory insight.

Streamline data prep for regulatory reporting