Xceptor AI-powered Tax Document Intelligence

Extract. Transform. Automate

The tax document burden

Financial institutions handle vast amounts of complex tax documents – withholding certificates, tax reclaim forms, beneficial owner declarations, and more. These documents arrive in countless formats with critical data buried in unstructured fields, making manual processing slow, error-prone, and costly. Traditional OCR falls short on tax documents due to format changes and handwritten content, limiting their accuracy and value. Many custodians and banks want to leverage AI to automate tax document workflows, but struggle with implementation, integration, and governance at scale.

Seamless AI for smarter tax document processing

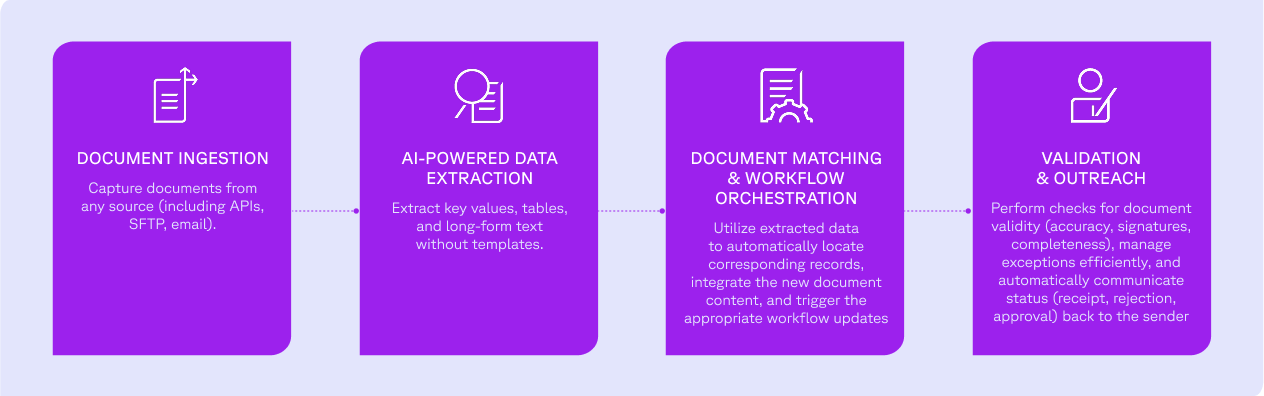

Xceptor’s AI-powered Document Intelligence transforms how financial institutions process tax documentation. By combining advanced AI with our market-leading data automation capabilities, we enable tax departments to extract, validate, and integrate critical tax data – without relying on rigid templates.

With Xceptor, AI works seamlessly within your existing tax workflows, helping you:

What can it do for you?

Xceptor delivers an optimized reconciliation process for greater accuracy and control – putting the power into the hands of the people that understand the business, and the data, the best.

-

Reduce manual effort Speed up balancing and correct discrepancies by ingesting and preparing the data up front

Reduce manual effort Speed up balancing and correct discrepancies by ingesting and preparing the data up front -

Accelerate time to market Respond quicker to market changes, and onboard new brokers / markets / instruments faster.

Accelerate time to market Respond quicker to market changes, and onboard new brokers / markets / instruments faster. -

Eliminate errors Proactively spot and resolve trade mismatches without manual intervention.

Eliminate errors Proactively spot and resolve trade mismatches without manual intervention. -

Total oversight Gain a comprehensive real-time snapshot of equity balances encompassing P&L, trades, positions, and cash flows in one consolidated view.

Total oversight Gain a comprehensive real-time snapshot of equity balances encompassing P&L, trades, positions, and cash flows in one consolidated view.

How we achieve greater straight-through processing (STP) while maintaining auditability.

Detailed MI and reporting available from the same UI.

.png?width=1200&height=654&name=image%20(5).png)

Xceptor Tax Document Intelligence provides confidence scores, ensuring data reliability and reducing errors.

Key Features

AI-Driven Data Extraction

Eliminate manual errors with automated, scalable extraction from unstructured documents, including handwriting and tables.

Intelligent Text Analysis

Use LLMs to classify, translate, and analyze document content.

Customizable Validation

Tailor validation rules to meet specific regulatory, client, or business needs.

Flexible AI Model Integration

Choose pre-built models or integrate your own for greater control.

Multi-Source Data Integration

Integrate validated data across various applications and workflows

Enterprise-Grade Governance

Maintain full transparency with audit trails, role-based permissions, and model monitoring.

No-Code Interface

Empower business users to configure and manage workflows without IT dependency.

Smart Document Segmentation

Automatically split single PDFs containing multiple tax documents into individual files, streamlining processing and reducing time spent on bulk scanned documents.

With Xceptor, AI just works.

Say goodbye to manual document processing.Say hello to AI-powered efficiency.