Continued growth for private credit creates new challenges for operations teams

Month/quarter end periods pose difficulties for operations teams as they must process a peak volume of loan notices.

Overcome notice volume and complexity by combining automation with AI

Month/quarter end periods pose difficulties for operations teams as they must process a peak volume of loan notices.

Manually processing large volumes of notices drastically increases the potential rate of errors and therefore delays in reconciling P&L, for example.

Delayed response times to time-sensitive notices (particularly defaults and amendments) can expose the firm to increased risk (including potential financial damages).

Inconsistent notice formats from different agents require specialized knowledge creating key person dependencies, longer processing times, and increased costs.

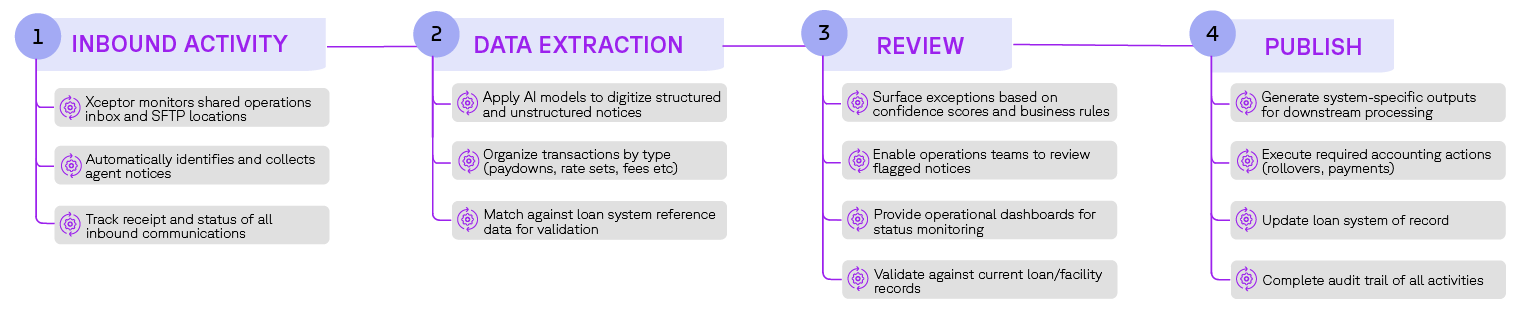

Xceptor delivers an optimized reconciliation process for greater accuracy and control – putting the power into the hands of the people that understand the business, and the data, the best.

Xceptor simplifies loan notice management by transforming complex, unstructured notices into standardized data flows that seamlessly integrate with your accounting systems.

Our solutions:

Our platform helps operations teams process notices faster whilst reducing costs.

Process more notices without increasing headcount.

Leverage AI for data extraction.

Complete audit trail.

Handle volume spikes without service impact.

Fully automate a previously out of reach process.

Chief Information Officer

We knew Xceptor would make a difference and are really impressed by how much it has delivered. Xceptor is the perfect flexible data management solution to fit with our aim of delivery superior service using leading technologies.